Today, Dr Neil Hudson MP welcomed the ambitions of the Chancellor of the Exchequer’s Spring Statement, however, the Penrith and The Border MP is urging the Chancellor to go even further to tackle the unique challenges facing rural communities and vital industries in the local area.

Today’s Spring Statement announced the Chancellor’s Tax Plan, with measures centred around three aims: supporting families with the rising cost of living; creating conditions to create private-sector growth; and sharing the proceeds of growth fairly.

Dr Hudson welcomed tax cuts for households facing a cost-of-living crisis, including a rise in the rate at which earners begin paying National Insurance from £9,500 to £12,750, and the largest cut in fuel duty in history, worth 5p per litre. The Chancellor also restated planned support for the retail, hospitality and leisure sectors, including a 50% saving in business rates of up to £110,000.

The Statement also announced measures to save energy bills for households by reducing the 5% VAT on items that improve the energy efficiency of homes, including solar panels, to 0%.

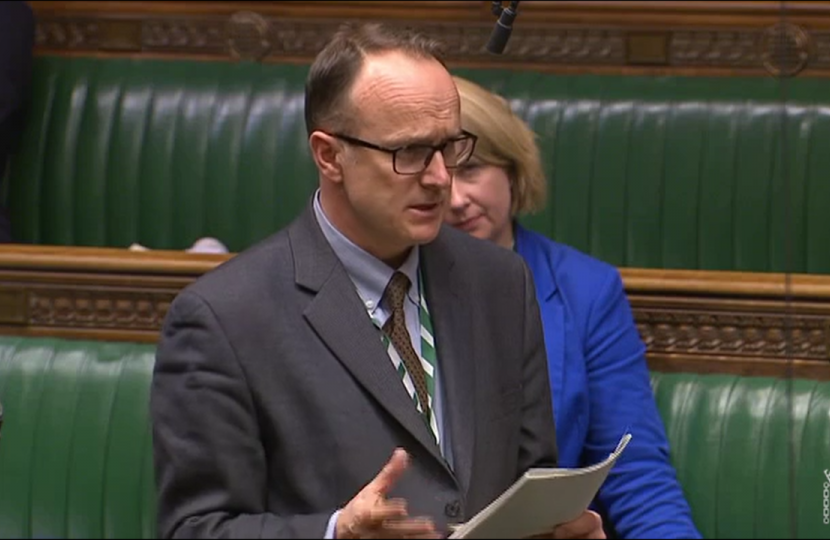

Dr Hudson commented: “I welcome the measures announced today most notably the increase in National Insurance threshold and the cut in fuel duty. However, as I laid out last week in the House, the cost-of-living crisis is presenting a combination of uniquely harmful challenges for rural communities. The Chancellor needs to take further action immediately to tackle the threat of the cost of living facing rural communities. I am still calling for the VAT reduction for tourism and hospitality sectors that is coming to an end to be extended moving forward and I still think we need further action on energy and fuel costs and also action on the fertiliser crisis facing the agricultural sector. The emergency support provided to businesses by this Chancellor during the pandemic was a vital lifeline to their survival, but if we want to shore up businesses moving forward, the Chancellor needs to bring in more targeted support measures for the tourism, hospitality and farming sectors that are part of the lifeblood of the Cumbrian economy.”