Epping Forest MP, Dr Neil Hudson, has again voiced serious concerns regarding Labour’s impending Education Tax, which is set to affect families of 2,053 pupils in the Epping Forest Constituency.

Ahead of its introduction, the impact of this new tax has already forced nine independent schools across the country to close, unable to absorb the additional 20 percent VAT charge without making their fees unviable for parents.

However, the true impact of Labour’s Education Tax will only really start to be felt once introduced in January 2025 – when schools will see a 20% tax introduced overnight – the first time education in the UK has been taxed since the introduction of VAT.

Children with special educational needs and those from military families are particularly vulnerable to this new tax, as it may make specialised support through independent schooling unaffordable for hard-working families. Additionally, the proposed tax poses a significant risk of disrupting the education of both pupils with an ECHP and those preparing for examinations. For these students, maintaining continuity in their learning is crucial to ensuring their academic progress is safeguarded.

Despite warnings from headteachers, parents and think tanks, Labour is proceeding without producing an impact assessment on the tax’s financial implications or it’s disproportionate effects on certain groups.

Having submitted written questions to both the Department for Education and the Treasury, Dr Hudson remains firmly committed to opposing this policy and holding the Government to account.

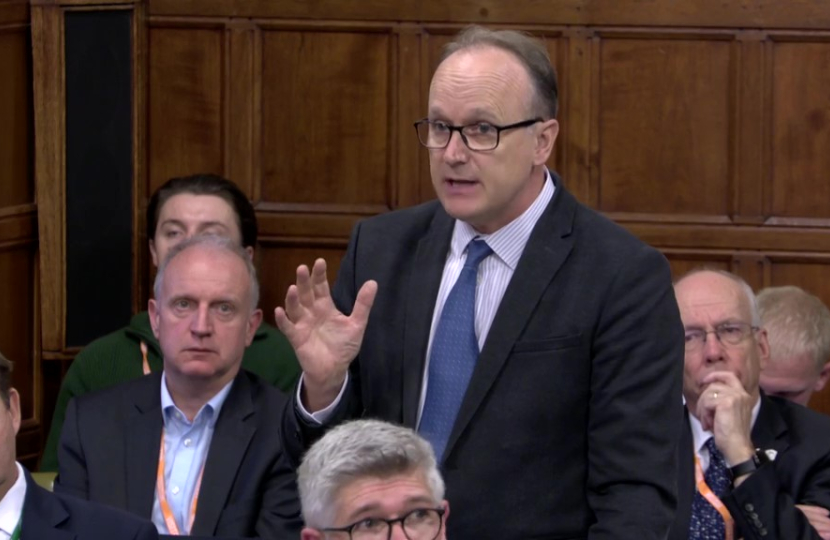

Speaking in this week’s debate in the Commons, Dr Neil Hudson, MP for Epping Forest said:

"Hard working families sacrifice huge amounts to put their children into independent schools.

“There are over 2,000 pupils in Epping Forest in independent schools. Does my Honourable Friend agree with me that this Labour policy of removing VAT and business rates exemption from independent schools will impact pupils right across the country, including SEN pupils, and also will impact our fantastic local state schools, who will be hit with a serious capacity issues when pupils are forced to transfer; that this policy is about the politics of envy rather than the politics of evidence."

Speaking afterwards, the Epping Forest MP added:

“I am deeply concerned that this retrograde Education Tax being introduced with no forethought by Labour will negatively impact so many young people at such a crucial stage of their lives. I am also worried it will force the generous bursary system offered by independent schools to decline. I am resolute that I oppose this change and will stand up for outstanding quality of Epping Forest’s independent and state schools against this short-sighted and damaging policy.”

Shadow Education Secretary, Damian Hinds said:

“All education and training provision is exempt from VAT. Labour’s Education Tax is a worrying development that could be a slippery slope. We are against this retrograde step.

“The impact of the Education Tax could see thousands of pupils move to state schools, increasing class sizes and disruption for teachers and pupils, increasing costs for the taxpayer and ultimately making it less likely that parents will secure a place at their preferred choice of school. Labour have said the prospect of larger class sizes in the state sector is “fine”; we disagree.”